Accountants are financial professionals who play an indispensable role in managing and analyzing financial data for businesses, individuals, and organizations. Whether you’re a business owner seeking financial clarity or an individual planning your taxes, understanding what an accountant does is vital. In this article, we’ll explore the accountant definition, delve into their duties, and highlight why they are essential in today’s economic landscape.

Accountant Meaning and Definition

An accountant is a professional who examines, organises, and manages financial records. They play a pivotal role in ensuring compliance with regulations, providing insights for better decision-making, and maintaining the financial health of an organisation. Beyond bookkeeping, accountants often engage in project planning, cost analysis, and risk management.

In short, the accountant’s meaning is much broader than most people assume. Accountants are problem-solvers, strategists, and trusted advisors in the financial realm.Visit our homepage to learn more about our expertise in financial services.

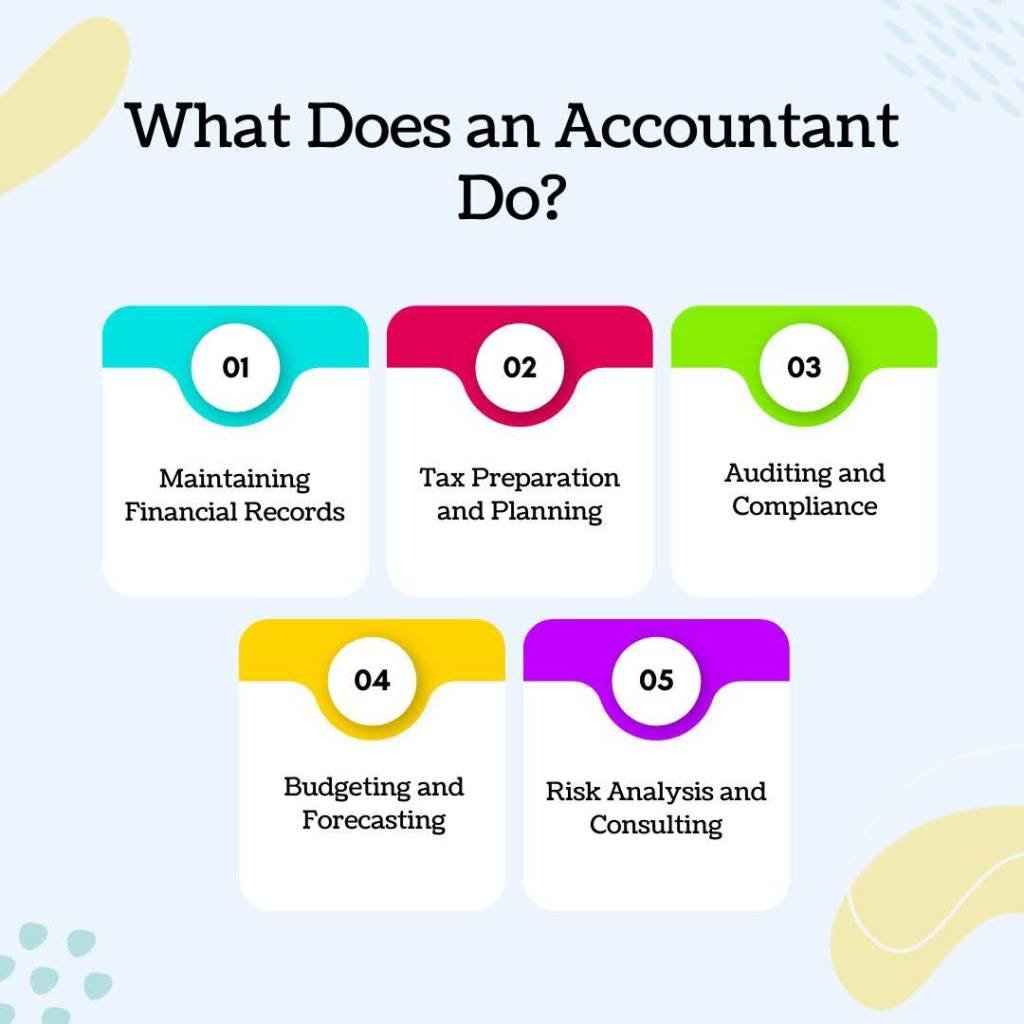

What Does an Accountant Do?

Understanding what an accountant’s roles entail requires a closer look at their day-to-day tasks. These include:

- Maintaining Financial Records: Accountants ensure accurate documentation of income, expenses, and liabilities.

- Tax Preparation and Planning: They prepare tax returns and identify strategies to minimise tax liabilities.

- Auditing and Compliance: Accountants review financial statements for accuracy and ensure compliance with legal standards.

- Budgeting and Forecasting: They create financial plans and forecasts to guide future decisions.

- Risk Analysis and Consulting: Accountants help organisations identify financial risks and optimise operational efficiency.

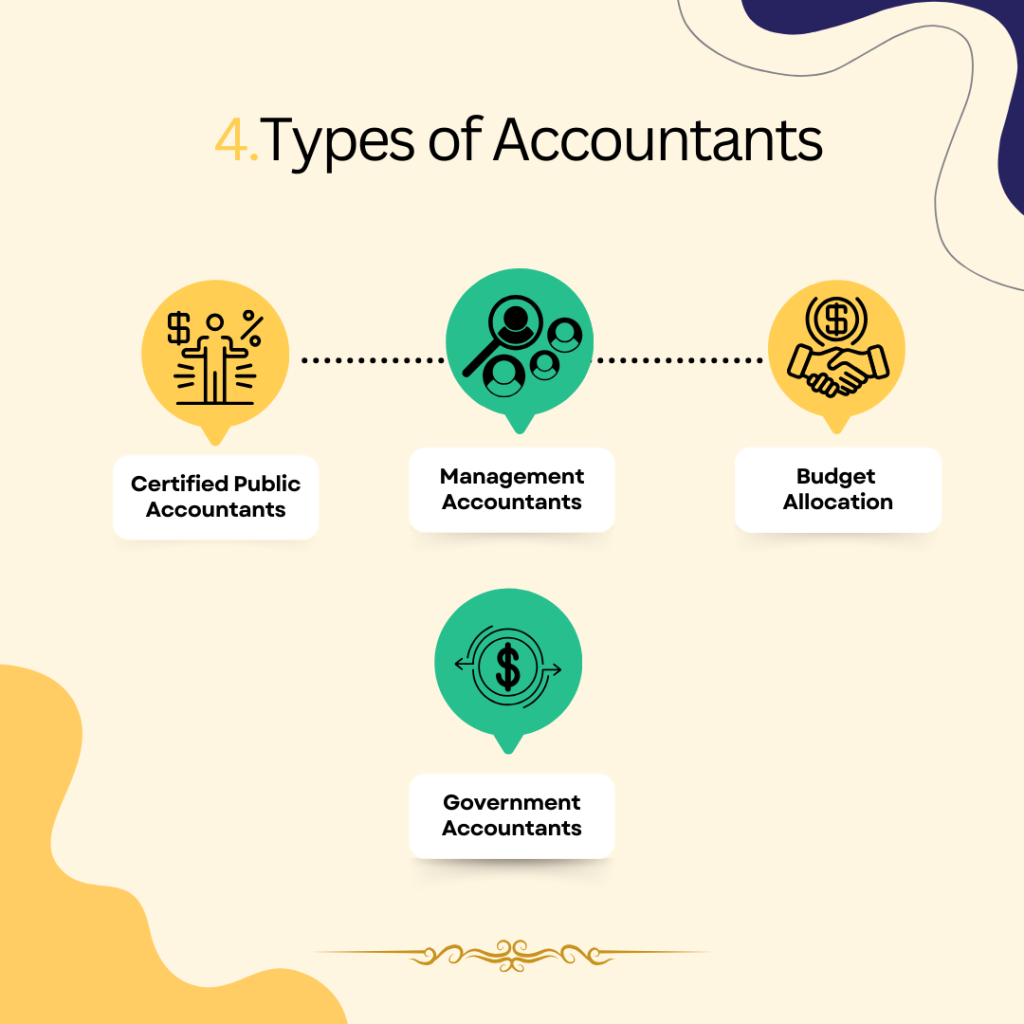

Types of Accountants

To better grasp what is an accountants, it’s essential to understand the various specialties within the profession:

- Certified Public Accountants (CPAs): CPAs have passed rigorous exams and meet state-specific licensing requirements. They handle complex audits, SEC filings, and tax strategies.

- Management Accountants: Focus on budgeting, cost management, and performance evaluation within an organisation.

- Forensic Accountants: Specialise in investigating financial discrepancies and fraud.

- Government Accountants: Work for public entities, managing funds and ensuring regulatory compliance.

Each type of accountant brings unique expertise, making the accountants’ meaning diverse and multifaceted.

Skills and Duties of Accountants

Accountants require a mix of technical knowledge, analytical skills, and ethical standards. Their key responsibilities include:

- Conducting audits and evaluations of financial operations.

- Preparing and analysing financial statements to ensure accuracy.

- Advising on cost-saving measures and operational efficiencies.

- Filing and managing tax obligations for individuals and businesses.

Accountants often pursue certifications such as CPA, CMA (Certified Management Accountant), or CIA (Certified Internal Auditor) to enhance their expertise.

Looking for professional accounting services? Explore our accountant services page to see how we can help!

Ethical Standards for Accountants

A crucial part of understanding what an accountant entails is recognising their ethical obligations. Accountants adhere to strict principles such as:

- Transparency: Ensuring financial records are clear and honest.

- Fiduciary Responsibility: Acting in the best interests of their clients.

- Compliance: Following frameworks like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Certified public accountants, in particular, bear a fiduciary duty to their clients and must uphold high standards of integrity and professionalism.

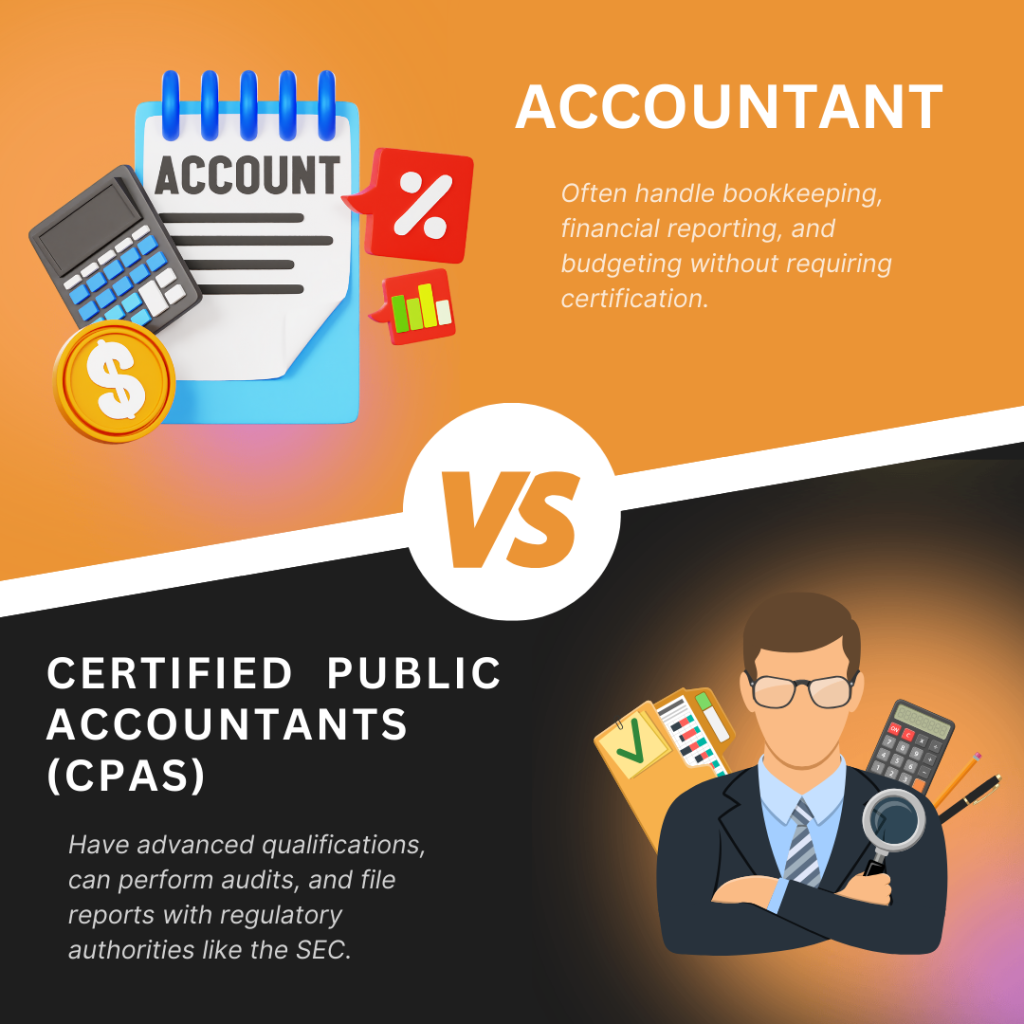

What is the Difference Between an Accountant and a CPA?

While all CPA’s are accountants, not all accountants are CPA’s.

- Accountants: Often handle bookkeeping Services, financial reporting, and budgeting without requiring certification.

- Certified Public Accountants (CPAs): Have advanced qualifications, can perform audits, and file reports with regulatory authorities like the SEC.

The CPA designation is considered the gold standard in the accounting profession.

How Much Do Accountants Earn?

Accountants in the United Kingdom enjoy competitive salaries, with median earnings reaching approximately $79,880 annually as of 2023, according to the Bureau of Labor Statistics. However, Here’s a table summarising accountants’ earnings in the UK based on key influencing factors:

| Factor | Impact on Earnings |

| Median Salary | $79,880 annually (2023). |

| Certification | Certified professionals (e.g., CAs or CPAs) typically earn 20-40% more than non-certified accountants. |

| Experience | – Entry-level: $40,000 – $50,000 annually.- Senior roles: $90,000+ annually. |

| Specialisation | Specialists (e.g., forensic accounting, tax consultancy) often earn $100,000 or more. |

| Location | Salaries tend to be higher in London and other major cities compared to rural areas. |

| Industry | Accountants in sectors like finance or law usually earn more than those in public service. |

This breakdown shows how various factors shape an accountant’s earning potential.

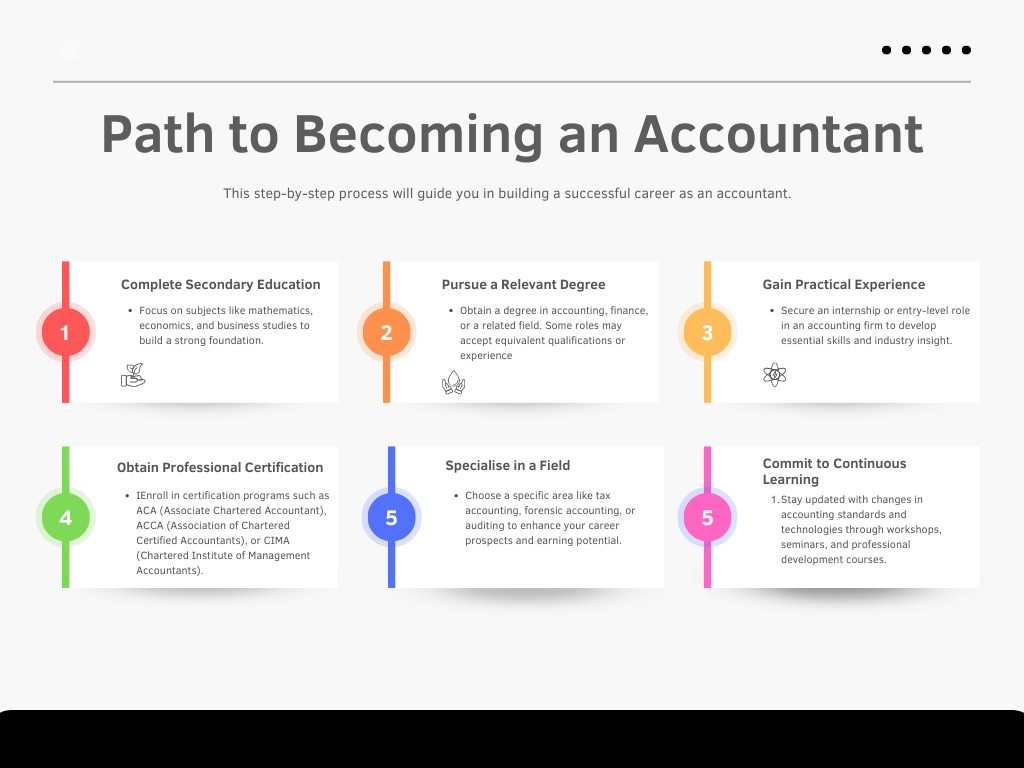

How to Become an Accountant

Path to Becoming an Accountant: 6 Essential Steps:

To pursue a career as an accountant, you typically need:

- A Bachelor’s Degree: In accounting, finance, or a related field.

- Certifications: Depending on your career goals, certifications like CPA, CMA, or CIA are valuable.

- Experience: Hands-on experience is essential, especially for certification eligibility.

To become a CPA, candidates must pass the Uniform CPA Examination, which tests knowledge across financial accounting, auditing, and business concepts.

Why Accountants are Always in Demand?

Every organisation, regardless of size, relies on accountants for financial stability. From managing daily transactions to creating long-term strategies, accountants help businesses thrive. Additionally, individuals benefit from their expertise in tax planning and financial management.

In essence, the accountant definition reflects their critical role in navigating the complexities of the financial world

Accountants are indispensable in ensuring financial stability and guiding strategic decisions for individuals and businesses alike. Their expertise in compliance, planning, and risk management makes them vital in today’s complex economic environment. If you’re looking to optimise your financial operations or need expert tax planning, consider consulting a professional accountant today. Empower your finances with the expertise of a trusted advisor!